Russia’s best mobile bank app in 2013–2018 (as recognised by Deloitte and Markswebb Rank & Report). Best iOS banking app for retail customers in 2017 and 2018, according to UsabilityLab. Best mobile bank app in Central and Eastern Europe in 2018, according to Global Finance.

We continue to grow. Going beyond mobile banking, the Tinkoff app offers its users services galore, be it about movies, concerts, theatres, travel, restaurants, shopping, health, or beauty parlours.

You can sign up for any Tinkoff product right in the app and make an appointment with a bank representative right away. After that, all you need is to register in the app using your phone number and activate a card.

Payments and transfers:

∙ Pay your mobile phone, Internet and utility bills, fines, fees for government services, etc.

∙ Transfers to any bank using mobile number, account details or card number

∙ Transfers to foreign bank cards

∙ Regular transfers and automatic payments of taxes, fines, utility bills

∙ Scanning and payment of receipts without entering payment details

∙ Check and pay your traffic fines, subscribe to be notified about new fines

∙ Subscriptions to utility bills and debts owed to the Federal Tax Service and Federal Bailiffs Service

∙ Pay invoices (for example, those issued by the Federal Tax Service or online stores)

∙ Cash withdrawal from Tinkoff ATMs using QR codes

∙ Pay for transport cards, toll road travel and parking

∙ Detailed payment and transfer receipts

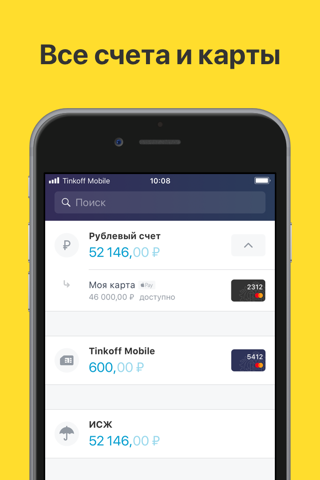

Tinkoff product management:

∙ Information about your accounts, deposits and loans

∙ Open savings accounts and set savings goals to monitor your progress

∙ Add other banks’ cards for Tinkoff payments and fast top-ups

∙ Order additional cards and provide limited access for other card holders

∙ Tinkoff Insurance: third-party liability and motor hull insurance policies, travel insurance policies

∙ Transaction statements, bank statements for visa application, account statements

∙ Enable and configure the overdraft function

Features for cards:

∙ Add Tinkoff cards to Apple Pay (MasterCard and Visa)

∙ Set or change your PIN

∙ Lock, replace, and order additional cards

∙ Order additional virtual cards

∙ Top up your account using cards of other banks

Tinkoff Junior cards for children

∙ Order a card for your kid

∙ Manage accounts and limits

∙ Track your kid’s location

∙ Tasks and rewards for completion

Search and analytics:

∙ Spending tracker with detailed breakdown by deposit and account

∙ Expense statistics that you can filter by date, account, or name

∙ Searching the entire app: transactions, favourite payments, events, providers, and contacts

Bonuses:

∙ Select and view increased cashback categories and your projected cashback value

∙ Receive special offers and notifications about new promos

∙ Manage your bonus points and air miles for loyalty-enriched cards

∙ Enjoy interest-free instalment plans for credit cards

∙ Refer-a-friend programme

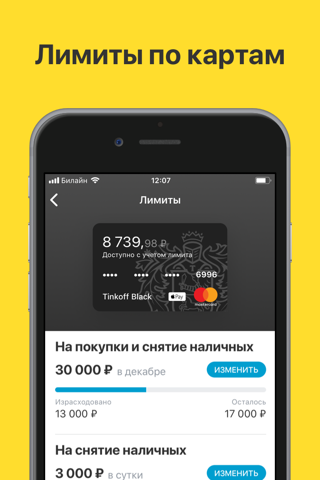

Security:

∙ Transaction limit management

∙ Overseas transactions

∙ Security questions

∙ Logging in using Touch ID or Face ID

And more:

∙ Stories: information about money and events, selection of movies, reviews of articles, tips for travellers, etc.

∙ Best currency exchange rates (closest to the current FX trade)

∙ 24/7 support via chat, email, calls using the app or phone, social networks

∙ Top-up locations with filters by partner, currency, amount

∙ ATMs close to you

∙ Exchange rates of Tinkoff and the Bank of Russia

*An instalment is a purchase loan using the Credit Limit. If no Regular Payment is made, the RUB 7.27 Tariff Plan applies subject to the Terms of the Instalment. Interest rate starting from 29.9%, credit limit of up to RUB 300,000, demand loan. For more details on Fees/Payments, please go to https://www.tinkoff.ru/cards/credit-cards/tinkoff-platinum/tariffs/. Tinkoff Bank